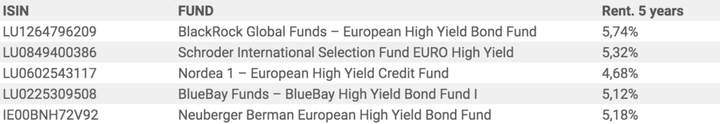

We analyse the Top 5 High Yield Bonds in Europe

26 MAY, 2021

By Constanza Ramos

Worldwide High Yield Bonds still on the top of the mind of some investment professionals that decide to invest their clients' wealth on this type of asset. High Yield Bonds can also receive a good amount of rentability, however it is more common for the investors to talk about equities, and active management. In this article we will look at the Top 5 High Yield Bonds with insights from Bonds BlackRock, Schroders, Nordea, BlueBay, and Neuberger Berman.

Jose Aguilar, Head of European High Yield Bonds at BlackRock

The BGF European High Yield Bonds Fund’s objective is to deliver attractive risk-adjusted returns for its clients.

Benefitting from highly experienced Portfolio Managers and the largest dedicated high yield bonds investment team in Europe the Fund’s long-term demonstrated ability to generate alpha for investors in both positive and negative return environments makes it stand out from its peer group.

This all-weather approach, with a great focus on credit selection, that has outperformed its benchmark index virtually every quarter over the last 5 years demonstrating the team’s ability to construct a balanced and diversified portfolio and adapt it over time.

Despite the recent tightening of yields across fixed income asset classes, high yield bonds continue to offer attractive income which is simply no-longer available in other areas of liquid credit in Europe.

Looking at year-to-date returns across asset class, European high yield bonds have significantly outperformed other segments of the fixed income market like government bonds or investment grade.

It is our belief that this outperformance will continue in the second half of the year given the superior income and lower duration risk, making European High Yield bonds a staple in any balanced portfolio.

From a macroeconomic point of view we are still in the “Recovery” part of the economic cycle in Europe, which has been traditionally very supportive for an allocation to high yield.

BlackRock’s Investment Institute is also constructive on the asset class for the medium-term, given the strong prospects for an accelerated earnings recovery supported by abundant stimulus and accelerating vaccine rollouts, which should result in default rates below the long-term average.

It is important to highlight that High Yield is an asset class that provides opportunities to consistently generate alpha as it has been proven by our track record. 2020 became a great year for active managers as the Covid-19 crisis created record dispersion across credits and industries.

While that dispersion has decreased in the last few months, we believe that the second half in 2021 will bring plenty of opportunities to generate alpha by credit selection as we transition into the “Expansion” part of the cycle.

In summary, our view is that European High Yield remains a unique proposition in fixed income in the current environment by providing attractive returns low interest rate sensitivity given its low duration profile, and low default rate.

In BlackRock, we are confident we have the right team, experience, and investment skill to continue to deliver superior risk-adjusted returns to our clients over the medium term.

Hugo Squire, Fixed Income Portfolio Manager, Schroders

A sweet moment for European high yield bonds

We are beginning to see the light at the end of the tunnel. The economic upturn continues, particularly in the US and the UK, while in Europe it is gaining momentum. But for the bond market, the key question is whether the rise in inflation we are seeing will cause central banks to think about reducing or tightening monetary policy.

However, it still seems unlikely that central banks will remove their support and Europe may even have to do more. This will keep bond yields at low levels and in this scenario, we believe that the search for income is likely to support demand for credit, especially high yield.

Government bond yields protect High yield credit against turbulence. As markets seek to "price in" the dramatic change in growth prospects, uncertainties about future monetary and fiscal policy abound. This has led to volatility in global sovereign bond yields and negative total returns so far this year in many parts of fixed income.

However, The clear winner in this environment is the high yield credit where spread compression and the comparatively short duration of the asset class have helped (a measure of the sensitivity of bond prices to changes in yields or rates).

Moreover, we believe that this scenario will continue over the course of the year, especially as a rise in rates would generally reflect the improving economic outlook, which should allow high yield companies to offer higher yields and improve their creditworthiness.

On the other hand, other factors favouring high yield credit are the improving outlook for downgrades and defaults.

Sectors where we see value

In building the portfolio of the Schroder ISF EURO High Yield fund, we look for long-term themes and trends, identifying companies that can benefit from these trends. In this regard, we are currently highlighting opportunities in the healthcare sector.

We continue to see very favourable long-term themes in companies specialising in areas such as pain management, biosimilars and off-patent branded drugs.

We also like some non-cyclical sectors, such as telecommunications and media, while we continue to overweight transportation and real estate. In addition, we believe that value areas with incipient recovery potential in sectors affected by Covid-19 should not be overlooked.

That said, while the high yield backdrop looks broadly favourable, it is important to take a selective approach amid continued uncertainty around the pandemic and the elevated levels that some parts of the market have reached.

But attractive returns, relative to almost all other areas, and modest duration put high yield bonds in a sweet spot for the remainder of this year.

Fredrik Strand, Portfolio Manager Nordea 1 European High Yield Credit Fund

The Nordea 1 – European High Yield Credit Fund is a bottom-up focused portfolio which builds on security selection as it aims for outperformance vs the broader European high yield market.

We believe fundamental bottom-up credit analysis and identification of relative value are our key competences and focus to identify misspriced credit risks within the European High Yield market.

In line with our historical track, current portfolio ideas are based on high conviction selection, and we do not apply any top-down macro views, nor market directional positioning.

Alpha comes from deliberate deviations on specific risk components vs the market which are accepted to the extent that they are compensated by expected relative value generation.

A main characteristic for our portfolio is that we invest across the full high yield risk spectrum, and that we do not aim to fully avoid defaults a priori.

We acknowledge that tricky investment cases may contribute to alpha and we cannot allow ourselves to fear any investment opportunity. We always aim to take the appropriate level of risk, not too much but also not too little.

As opposed to trying and avoid tricky situations, we focus on pricing risks correctly and size portfolio positions relative to identified risks.

With only one default registered in April in our space (Codere, a Spanish based gaming company not held in the fund), and continued support for the credit space from the central banks, 2021 is unfolding with relatively low volatility.

Especially in the last weeks, returns are predominantly generated by carry and spreads from a broad base of names slowly going tighter, more so in the lower rated names than the higher ones. The primary market has also been busy with many issuers taking advantage of the favourable markets.

Another topic which creates some tension is aggressive M&A from the winners of Covid-19 to drive the equity value with not only the excess cash generated but also from additional debt capacity created by the, for the lucky few, favourable backdrop.

The global trade-flow disruptions has not yet had a material impact on the European High Yield market but it is certainly something to focus on.

Justin Jewell, Senior Portfolio Manager at BlueBay Asset Management

Like all asset classes medical improvement and reopening will play a big role in the sectors that perform best and overall returns.

For the BlueBay High Yield Bond Fund, our overweight risk bias ensured we were able to capture this market strength. Over recent months financials have been the largest contributor to excess returns; as well as our preference for lower-rated B and CCC credits outperformed.

Our positions in cyclical and moderately Covid-exposed sectors

Such as retail, utilities and transportation also head up the leader board for the funds best-performing sectors. We think the theme of recovery and re-opening will remain a major driver at the sector level thought the theme’s influence on the wider market has now waned.

At the same time, we remain disciplined in reducing our exposure to names that are trading below our spread targets; and are currently underweight basic industry resources, which have been a small drag on excess returns.

Looking ahead, we remain constructive on the outlook for the wider leveraged-finance asset class due to the expected economic recovery and low default expectations. A rates shock to credit is a possibility, although not yet the base case.

Plus, when looking across the fixed income opportunity set, high yield is relatively short duration and high yielding.

Therefore, we believe it is more able to absorb the kind of normalisation of the rate curve that may occur in the US over the next 24 months than any other fixed income asset class.

From our perspective, monetary policy is not to be feared as a source of negative returns, particularly in Europe, more something to be aware of as a source of possible volatility which could influence portfolio positioning.

Outside of this market technicals also remain favourable. Today’s environment is broadly supportive for high yield flows over the medium-term, as investors need to find ways to deliver ‘safe income’ in a world where there are no real safe assets.

From a sector perspective, we are tilting towards a recovery/reflation theme. The tilt towards lower rated credit in portfolios has now probably passed its peak as the opportunity to benefit from “rising stars” has become more compelling. Those are names downgraded during the crisis that can become investment grade again as the recovery takes hold.

In terms of regional allocations, in 2020, we looked to the US as leading with an early recovery and a robust vaccine program, which has come to fruition with a spring 2021 re-opening and an accelerated economic recovery.

We’re now tilting towards Europe on the basis there is less scope for policy shock and inflationary impulse and therefore spreads and yields (which have lagged a little) now offer more value than in the US.

From a macro point of view, we expect further recovery through 2021 helping returns though there will be winners and losers from the new normal, post-covid world and good credit selection will be key.

With default levels well contained, demand pent-up and monetary policies supportive, we are positive on the high yield asset class and predict the continuation of constructive flow dynamics well into 2021.

Vivek Bommi, CFA, Senior Portfolio Manager, Neuberger Berman European High Yield Bond

Across Europe, the path to reopening is varying sharply by region with the UK’s early progress with vaccinations at time of writing being in sharp contrast to the rest of Europe.

Nevertheless as mainland Europe catches up in the coming months, the path we see towards much lower infection rates and further ‘opening up’ of activity is encouraging.

Despite recent lockdowns, we note the strength in Manufacturing PMI’s in Europe in recent months an indicator that companies have found a way to continue operations. The reopening of the global economy we think sets the stage for some of the strongest growth rates since the great financial crisis.

The combination of generous fiscal and monetary support, pent-up demand for travel & leisure, and businesses rebuilding inventories we believe will result in sharply improving economic growth this year.

We believe the combination of good levels of growth and easy financial conditions provide an attractive backdrop for European High Yield bonds issuers allowing companies to grow earnings and so reduce financial leverage.

Default rates, which reached a peak of 4% in March bolstered by a modest number of mostly Covid-19 related defaults last year, will now drop back down to 1% or lower we believe in the coming year. In this context, we view the 320bps spread on offer in European High Yield as attractive.

Our bottom-up approach of fundamental analysis remains a key differentiator as we seek to leverage our relationships with management teams to understand how corporates are positioning in preparation for life after Covid-19.

This has included and will continue to include assessing which companies and business models are likely to have seen permanent structural shifts in this period of heightened change. In this environment, and with that approach, we continue to find investment opportunities for the fund which provide an attractive balance of risk and reward.

We will continue to look to tactically take advantage of pockets of volatility to add to issuers with more stable fundamentals and compelling valuations.

New issuance has started the year firmly with most companies able to access new capital. We expect markets to remain open and for the M&A pipeline to build as the year progresses.

Finally, we note the improving quality composition of the benchmark as measured by the ratings agencies. The addition of higher rated so called ‘fallen angels’ last year bolstered the proportion of BB rated issuers to 71% of the benchmark, up 4pts since the start of last year.

This is despite the impact of the multiple issuer downgrades in Q2 and Q3 of 2020. We anticipate this year and next we will see net ‘upgrades’ by the rating agencies and opportunities for spread tightening as some issuers return back to Investment Grade as ‘rising stars’.

We continue to view spreads in European High Yield as attractive in relation to our estimation of future credit losses/defaults but also as relates to the shift in overall quality composition of the asset class.

Related articles

What are the perspectives for commodities? What is the global impact of them?

What are the perspectives for commodities? What is the global impact of them?By Marco Mencini