Water: the new commodity of the 21st century?

31 AUG, 2021

By Charaf Louhmadi

Water: a vital natural resource decreasingly abundant Our blue planet contains 96.5% salt water and 3.5% fresh water. Most of this fresh water is stored as ice and snow in the mountains and at the North Pole. Only 0.3% of fresh water is drinkable and available for human supply. While demand for water is growing sharply, resources are increasingly limited. This growth in demand is explained by the acceleration of urbanization, the rise of the world demography and the growing needs in the sectors of agriculture and industry.

Water resources are becoming increasingly scarce. According to the World Resources Institute, by 2040, most countries will no longer have enough resources to meet their water demand. Humans draw heavily from the water tables and aquifers that have taken millenniums to form.

Cities are starting to consider a "day zero" scenario during which fresh water will be cut off. This was the case with "Cape Town" which had announced the implementation of the “day zero” in April 2018, before postponing it thanks to a mobilization of its inhabitants which resulted in a significant reduction in their water consumption.

According to Vox Media, most of the world's major metropolises will experience a “day zero” in the coming decades.

The introduction of the water futures markets on the Chicago Stock Exchange

The Chicago Stock Exchange launched water futures contracts on December 7, 2020. This is the first time that water derivatives have been traded in the financial markets.

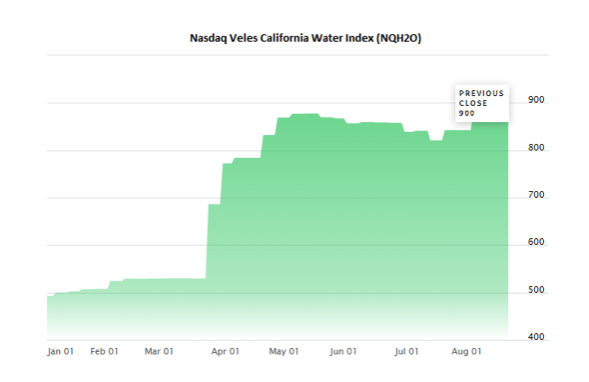

The underlying of these contracts is the Nasdaq Veles California Water index, an index created in 2018 by the Nasdaq in partnership with Veles Water and WestWater Research. The market spot capitalization at launch of futures derivatives is $ 1.1 billion.

This index denoted NQH20, has for unit, the dollar per acre-foot, or approximately one dollar per 1.2 million liters. It reflects the water exchanges carried out in the most important underground platforms in the State of California.

The NQH20 index, which quotes weekly based on water purchases made the previous week, jumped more than 83% between the start of the year and mid-August 2021, its value crossed 900 points as we can see it below:

Source: Nasdaq

The market introduction of water futures shows growing investor interest in the financialization of water. Hedge funds are already anticipating water scarcity in the coming decades. Willem H. Buiter, former chief economist at Citigroup believes that water will become the most important commodity ahead of gold and oil.

Water in Australia, a resource privatized by the state

A water market exchange has been set up in Australia, the hottest continent on the planet, where drought, directly linked to the country's growth, is a national problem. Dams are sometimes only 20% full.

The Australian State has established since 2007, through the “Water Act”, a system of water quotas, in the sectors of agriculture and industry, beyond which water can be exchanged.

Hedge funds and investors saw the opportunity for profit and water prices especially in the most arid regions have increased significantly: they have increased tenfold since the introduction of these markets, reaching $ 500. per million liter, which is not without consequences for the most modest farmers. In addition, the rates of return on these investments exceed 25%.

Since the 1990s, the Australian state has set maximum water extraction volumes not to be exceeded. Water holding rights are also traded in specific markets.

Australia's water scarcity and the growing impacts of global warming mean that the financialization of water is only in its infancy.

Why are investors increasingly interested in the water market?

There is growing interest among investors in water. Citibank specialists estimate in the "Solutions for the global water crisis" report published in 2017 that the water market will exceed one trillion dollars by 2025.

Within the main financial institutions of Wall Street, we now speak of "oil of the 21st century".

The UN, which recognized in 2010 that access to water is a fundamental right, estimates that by 2030, its scarcity will affect 40% of the world's population and that its international demand will grow by 50%.

As explained above, global population growth, overconsumption and global warming are accelerating this crisis which is likely to worsen rapidly and generate conflicts around the globe.

Hedge funds and investors are increasingly looking to anticipate this shortage and derive maximum benefits from it.

The economic and political consequences of the financialization of water

Some specialists consider that the consequences of a financialization of water would not be so dramatic, on the contrary. This is the case of Betsy Otto, Senior Fellow at the World Resource Institute, and member of the Global Water Program, who indicates that this would systematically imply a change in consumer behavior: a more economical management of water, especially in the industrial and agricultural sectors where it would be necessary to relocate water highly consuming practices from arid zones.

Conversely, it should be noted that, as has been observed in Australia, the financialization of water would subject this vital and universal resource to the speculations of investors and vulture funds, which would significantly increase inequalities in access to water which, let us remember, are already present.