Wasting time on Due Diligence

21 SEPT, 2020

By Constanza Ramos

The below article was written by Rob Sanders, Co Founder of Door, the digital fund due diligence platform. Rob has 23 years’ experience in asset management sales and marketing divisions. Before Co Founding Door, Rob was Global Head of Marketing at Aberdeen Asset Management and a member of the leadership team responsible for driving digital change - from building corporate digital strategy to digital client interfaces and investment platforms.

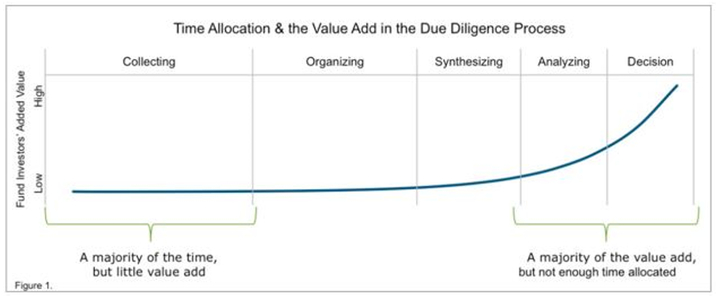

Manager research analysts spend too much time gathering and organising basic due diligence information from managers and not enough time using it for analysis and decision-making.

Well before the Coronavirus pandemic hit the headlines, manager research analysts were under increasing resource pressures. 69% of professional investors cited time constraints as limiting their effectiveness, according to a CaseyQuirk study published last year (Distribution 2.0). The current environment has only intensified this situation. Analysts were already contending with an ever-rising number of products to cover and growing regulatory pressures. Now they must add liquidity concerns, disaster preparedness, and the ability of their asset managers to cope with deflating asset values and outflows.

There are more distractions right now, notwithstanding home-schooled kids. The job is becoming more demanding in all the wrong ways. On-site meetings are out, Zoom is in and manager research teams need additional sources of information.

The information gathering process is antiquated and inefficient, particularly the issuing and receiving of due diligence questionnaires (DDQs). Constructing and sending requests for commonly sought information sucks valuable time from an analyst’s day. Too much administrative work, too much chasing managers for core information and updates. Detailed, robust information should be available when and where an analyst needs it, especially when due diligence is conducted from home.

Analysts should have the time and headspace to focus where they can add the most value to client outcomes, reduce risk and fulfil the obligations set out before them as fiduciaries. This means less time chasing managers for updates and more time for analysis and making well-informed decisions.

Due diligence is driven by detailed information flow – the more accurate and timelier the better. Current industry processes centred around the old DDQ/RFI/RFP have not advanced since the advent of email. Waiting around for weeks to get standard information back from managers is a waste of time. The traditional approach for gathering in depth qualitative information is broken.

Manager research and due diligence is about discovery, verification and comparative analysis. It’s about gaining insights by connecting information in new ways and understanding how managers and their investment strategies are evolving. Information flow should be a contributor to that process.

Coronavirus has put every asset manager and every strategy at the top of manager research teams’ priority list – all at the same time. Digitising and standardising the commonly sought information in due diligence questionnaires allows manager research teams to scale their monitoring efforts and access information anytime, anywhere – even from the kitchen table.