A tricky market environment

12 AUG, 2022

By Marie-Christine Lambin

Amid noisy and conflicting economic data, the fight between Bulls and Bears is raging. Signs of slower growth is considered as “good news” by optimist investors who see the case for a pause in Fed tightening or even rate cuts early next year. For the more pessimist ones, a renewed drop in US treasury yields is reflecting an upcoming recession. We admit it is difficult at this stage to say if we are heading to a soft landing, or a more severe drawdown. It is fair to say that we remain dependent on upcoming data to forge a view about the future direction of financial markets, as much uncertainties remain on the inflation and consumption front.

Inflation is showing signs of peaking but is unlikely to fade quickly

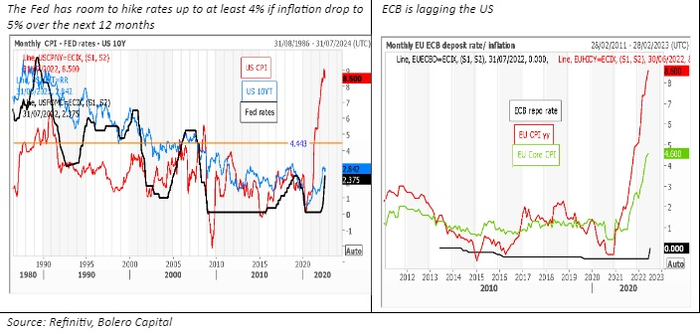

With major central bankers obviously behind the curve, hawkish stances are likely to stay

Recession risks likely more pronounced outside the US

Earnings estimates revised down

Investment conclusions

Flexibility is key

The recent U-turn in both equity and bond markets was quite surprising to us. After anticipating a marked worsening of the macroeconomic environment in the first half of the year due to rising inflationary pressures and more aggressive Fed tightening than anticipated, the S&P 500 has rebounded by 14% since June 16th’trough, suggesting that investors are betting on the end of the Fed's series of interest rate hikes, which

Related articles

Fixed income ETFs record net inflows worth 12,000 million dollars in the first quarter

Fixed income ETFs record net inflows worth 12,000 million dollars in the first quarterBy RankiaPro Europe