Top 5 Passive management Asset managers with more inflows

26 MAY, 2021

By Constanza Ramos

As per Morningstar report on Passive management, Long-term index funds posted inflows of EUR 20.17 billion in April. Equity index funds enjoyed inflows of EUR 12.3 billion, and bond index funds drew in close to EUR 8.3 billion. The market of long-term index funds rose to 20.9% as of April 2021 from 19.8% as of April 30, 2020. When including money market funds, which are the domain of active managers, the market share of index funds stood at 18.6%, up from 17.2% 12 months earlier.

On this Passive management report, iShares topped the rankings of asset-gatherers by a wide margin, netting inflows of EUR 9.8 billion.

This is the second highest monthly net inflows ever recorded, only surpassed by February 2021 (Morningstar started collecting data on fund flows in Europe in 2007).

The iShares Core MSCI World ETF and the iShares $ High Yld Corp Bd ETF raked in EUR 1.1 billion and EUR 556 million, respectively.

Vanguard was the runner-up, netting EUR 3.2 billion. The top-selling fund was Vanguard S&P 500 ETF with EUR 547 million in net inflows, followed by Vanguard Global Bd Idx with EUR 529 million of new subscriptions.

Passive management winners, iShares attracted the most net inflows, followed by Vanguard and Amundi

Fund Providers: Largest Inflows, Passive (Excluding Money Market Funds)

| Estimated Net Flow (EUR Mil) | Org Growth Rate 1% | ||||

| Name | Net Assets (EUR Bil) April 2021 | 1 Mo. | YTD | 1 year | 1 year |

| iShares | 523 | 9,823 | 24,978 | 70,822 | 18.67 |

| Vanguard | 226 | 3,223 | 10,098 | 18,719 | 10.74 |

| Amundi | 93 | 1,105 | 5,008 | 15,994 | 25.57 |

| HSBC | 49 | 1,058 | 5,372 | 10,377 | 32.98 |

| Royal London | 25 | 887 | 1,360 | 1,332 | 7.19 |

Source: Morningstar

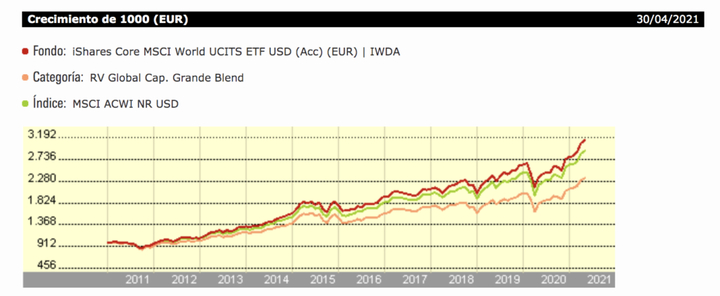

iShares Core MSCI World ETF

Source: Morningstar

IShares Core MSCI World ETF offers a sensible approach to gain exposure to the global-equity market. The fund retains its Morningstar Analyst Rating of Silver.

The exchange-traded fund aims to represent around 85% of the global developed equity market. Compared with the average offering in the global large-blend Morningstar Category, which includes both active and passive funds, this iShares fund has an overweighting in large caps at the expense of giant-caps and an underweighting in emerging markets. Nonetheless, it provides an adequate representation of the opportunity set available to investors.

At 0.20%, this ETF is among the cheapest within the category. While its ongoing charge is low, there are cheaper alternatives that are tracking the same index.

The ETF has shown above-average risk-adjusted performance during the trailing three-, five-, and 10-year periods compared with peers in the category. Additionally, this optimised ETF has outperformed its benchmark.

We attribute this to the quality of its portfolio optimisation as well as the fact that it is domiciled in Ireland, which allows it to reclaim dividend withholding tax from a number of countries.

Overall, we have a positive view on the strategy as defined by the MSCI World Index, as it is broad, diversified, and representative of the opportunity set available to investors.

The ETF is also one of the cheapest options offering global developed equity exposure.

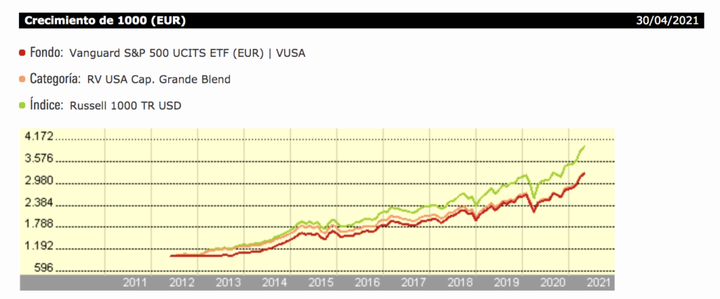

Vanguard S&P 500 ETF

Source: Morningstar

The Vanguard S&P 500 ETF is expected to continue to outperform its Morningstar Category peers over the long term, with passive investment approaches such as the one offered with this strategy becoming the standard for investors looking to gain exposure to large-cap US equities.

The fund has been awarded a Morningstar Analyst Rating of Gold.The parent index, the S&P 500, offers giant to mid-cap exposure and consists of 500 names, covering about 80% of the free-float adjusted market capitalisation of the US equity market.

This results in a well-diversified index, at both the stock and sector level.

Accordingly, passive strategies that track the S&P 500 index offer good exposure to the US equity market and stand as above-average options in a category where active managers have generally struggled to outperform.

The US equity market is highly liquid and efficient, meaning that material stock-specific valuation information is quickly incorporated into stock prices.

This limits the room which active managers have to add meaningful value. In fact, evidence over time shows that net active decisions in this market have tended to detract from returns.

This makes broadly diversified, low-cost passive strategies the default option for investors seeking this market exposure. The fund is priced attractively versus active peers who typically charge between 0.70% and 1.20%.

The fund is also priced competitively versus passive peers that track the S&P 500, with most priced above 0.10%. In summary, the fund offers passive exposure to a broad and diversified index of US equities in a Category where index strategies have built a strong investment case over active peers.

Related articles

Lombard Odier IM appointed by Nest for global thematic equity mandate

Lombard Odier IM appointed by Nest for global thematic equity mandateBy RankiaPro Europe

iM Global Partner launches the Global Core Equity fund, sub-managed by Richard Bernstein Advisors

iM Global Partner launches the Global Core Equity fund, sub-managed by Richard Bernstein AdvisorsBy RankiaPro Europe