Thinking about investing in biotechnology? Discover the best ‘biotech’ funds

11 MAR, 2021

By Ana Andrés

'Biotech' companies play an essential role in the future development of medicines that are threatening people's lives. Moreover, the pandemic has caused biotechnology to be at the forefront in the fight against the coronavirus. 2020 was a positive year for this sector, the MSCI World Pharmaceuticals, Biotechnology and Life Sciences index achieved a return of 10.57%. Additionally, it is worth mentioning that they, biotech funds, are still having a good performance so far this year.

In these recent decades, the world population has experienced significant growth. Among other reasons, one of the most influential ones is the spectacular growth in health technological advances. Specifically, the healthcare sector is made up of several subsectors. Apart from pharmaceutical companies, which represent a significant percentage of the sector, subsectors such as biotechnology, medical products, medical insurance, pharmaceutical services (hospitals, clinics, nursing homes, etc.), and cosmetics provide greater diversification to the investor.

Best 'biotech' funds

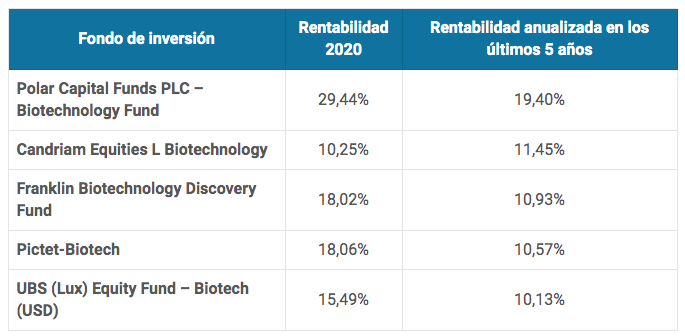

In this following table it is possible to observe the biotech funds that have had the best performance in these last five years:

As it is possible to observe, among all the funds, the Polar Capital Funds PLC - Biotechnology Fund stands out, with an annualized return of 19.40% in the last five years, according to Morningstar data as of March 3, 2021. At the forefront of this Polar Capital product is David Pinniger, who was our 'Manager of the Month' in June 2020, since 2013, and his portfolio is focused on US companies (weighing 64.81%). His three biggest positions are Alexion, Argenx, and Vertex. This product has experienced a very positive 2020 with profitability of 29.44% between January and December.

Evolution of the Polar Capital Biotechnology fund since its launch

In the second position in the ranking, it is possible to observe Candriam Equities L Biotechnology with an advance of 11.45% in the last five years and with Rudi Van den Eynde as the manager. This Candriam product invests globally in companies that develop medicines in the field of different diseases. Given the track record of innovation in the US biotech industry, the majority of the fund is invested in US companies.

Candriam Equities L Biotechnology Top Ten Positions

The third most profitable fund in the last five years is the Franklin Biotechnology Discovery with a return of 10.93%, and that during the past financial year was 18.02%. Evan McCulloch manages this Franklin Templeton fund and his goal is long-term capital growth by investing in equities of biotech and research companies located primarily in the US; In addition, it invests primarily in small-cap companies (less than $ 2 billion).

Market Cap of Franklin Biotechnology Discovery

Pictet-Biotech occupies the fourth position with a yield of 10.57% and 18.06% in 2020. The manager Pictet AM, led by Tazio Storni, has its focus on the other side of the Atlantic, with a weight greater than 90% of American values. Biogen, Vertex and Amgen occupy the top three positions in the portfolio.

Pictet-Biotech portfolio

Finally, it is possible to observe the UBS (Lux) Equity Fund - Biotech (USD) with a revaluation of 15.49% in 2019 and 10.13% since 2016. This fund from the house UBS AM is managed by Nathalie Lötscher. More than 85% of the portfolio is positioned in US companies, including Vertex, AbbVie, Gilead Sciences, Biomarin and Seagen.

Evolution of the UBS (Lux) Equity Fund - Biotech (USD)