These are the favourite French funds of European selectors and advisers, according to Sharing Alpha.

18 MAR, 2021

By Ana Andrés

In this article, based on the information provided by Sharing Alpha, the favourite French investment funds of the European fund selectors and advisers will be analyzed.

The Sharing Alpha initiative gives us the possibility to know the managers and the funds preferred by the European advisers and selectors. Fund selectors are asked to rate the funds based on their expectations based on three parameters (3 P’s):

| ISIN | Fund | Location |

| FR0000098683 | Lazard Convertible Global | France |

| FR0000990038 | Groupama Avenir Euro | France |

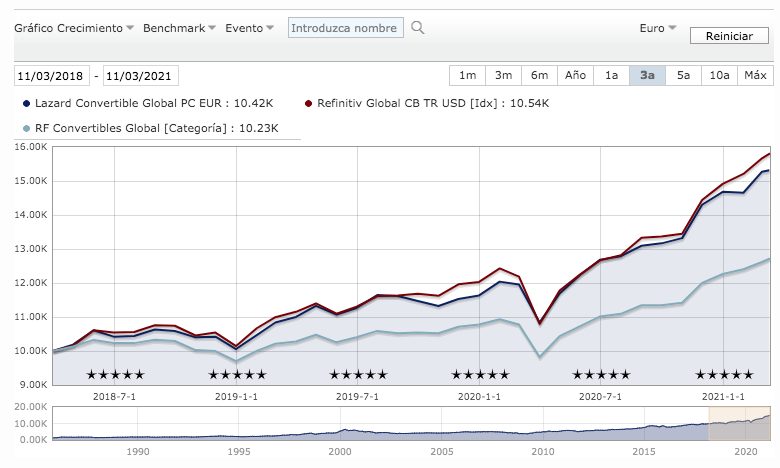

Lazard Convertible Global

The objective of this fund is to achieve, during the recommended investment period of 5 years, a net return higher than that of the Refinitiv / TR Global Focus Convertible Index Total Return hedged in EUR expressed in euros hedged against exchange risk having as currency referenced to the euro, after reinvesting dividends or net coupons. Stock performance may be affected by hedging costs.

To achieve this objective, the strategy is based on the active management of the various components of the convertible bond sector, such as the orientation of the equity markets, interest rates, and the volatility of options on stocks. In addition, it develops exchange risk management in order to optimize profitability. The composition of the Sicav portfolio is as follows: European and foreign convertible bonds issued by companies and financial entities, up to a limit of 100% of net assets.

In February 2021, the return of the SICAV Lazard Convertible Global PD H EUR was 4.24% compared to 3.02% of its benchmark Refinitiv / Thomson Reuters Global Focus Convertible Hedged EUR. The fund's equity sensitivity increased over the period and currently stands at 65.4% versus 56.3% for its index.

Sensitivity to interest rates increased slightly and remained below that of the index, at 1.94 versus 2.11. Our exposure to rates had an absolute negative impact against a backdrop of rising rates in the United States and Europe, while the relative impact was slightly positive. The narrowing of credit spreads in the United States and Europe, particularly for high-yield stocks, had a favourable impact in absolute terms and neutral in relative terms, as the fund's credit risk was lower than that of the index.

Our stock selection in the sectors that will benefit from the recovery - airlines, cruise operators, hospitality and online reservation services - had a very positive impact on relative performance during the month. Our e-commerce stocks also favoured relative performance. US financial services and European food delivery stocks, as well as our underweight to two specific US cloud and sensor production stocks, had a negative impact over the period. During the month we reduced our exposure to the food delivery sector and added three new positions in the sports and tourism equipment sectors (hospitality and reservation services).

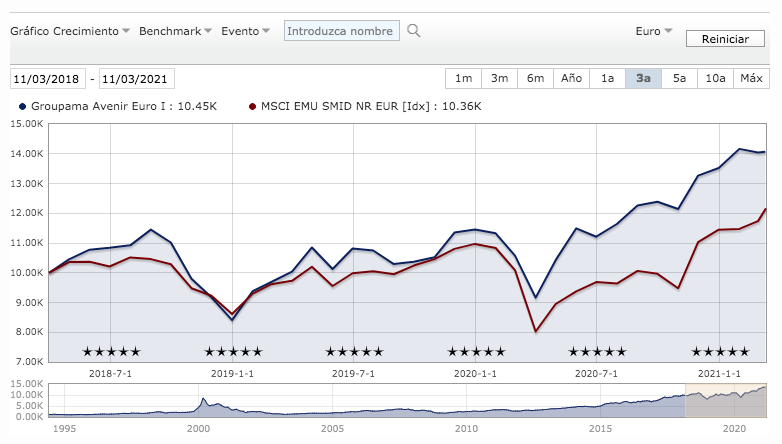

Groupama Avenir Euro

Groupama Asset Management's Avenir range consists of three funds and represents a total of € 3.1 billion (28/02/2021) of assets under management. Groupama Avenir Euro, within the range, is the oldest fund, since it dates from 1994, that shows the importance for the company of small and medium-sized European companies.

The investment process of the fund is based on the pure stock picking, the fund does not use derivatives or market timing, it is a 100% invested fund. The most important thing is to select those companies, with solid business models, that have the ability to grow in a period of three to five years.

On the other hand, the sector breakdown of the fund is the result of a bottom-up analysis, where the pure stock picking makes the final configuration of the strategy. The fund overweights tech, healthcare, and industrials. On the contrary, it does not invest in utilities or commodities. The same happens with the geographic breakdown, this is the result of the pure choice of the companies and not of a macroeconomic approach, currently, it has a significant bias towards Germany, France, and northern Italy.

Regarding the fund manager, Stéphane Fraenkel, he is one of the three managers in charge of writing the fourth stage of the Groupama Avenir Euro. He is a specialist small&mid caps European companies, in addition, he has experience in the implementation of ESG criteria and in global equities, two fundamental areas for the future of the strategy. In short, we are facing a very defined strategy for its investment process, improved over the years, but which maintains its essence since its creation, more than 25 years ago. This is why Groupama AM has established itself as one of the main international houses focused on small&mid caps European companies, with excellent results proven over the years.