Morningstar to Unite Two Forward-Looking Rating Systems into One: The Morningstar Medalist Rating

5 SEPT, 2022

By Leticia Rial from RankiaPro Europe

Morningstar is going to unite its two forward-looking managed investment ratings—the Morningstar Analyst Rating™ (Analyst Rating) and the Morningstar Quantitative Rating™ for funds (Quantitative Rating)—into a single rating: The Morningstar Medalist Rating™ (Medalist Rating). This change is slated to take place in the second quarter of 2023.

"Over the last decade, the Morningstar Analyst Rating and Morningstar Quantitative Rating have empowered investor success by accurately sorting funds based on future performance relative to a benchmark or its peers. By combining these two ratings, we are building on that strength while also simplifying the way we present information to investors. This should make it easier for investors to analyze, select, and monitor managed investments amid an ever-expanding sea of choices."

<em>Lee Davidson, head of manager and quantitative research at Morningstar.</em>

Currently, Morningstar conducts forward-looking assessments of managed investments in two ways: Manager research analysts qualitatively assess managed investments they cover, with those assessments culminating in the Analyst Rating, which takes the form of Gold, Silver, Bronze, Neutral and Negative. Morningstar uses algorithmic techniques to assess managed investments that analysts do not cover. Those quantitative assessments underpin the Quantitative Rating, which takes the form of GoldQ, SilverQ, BronzeQ, NeutralQ, and NegativeQ.

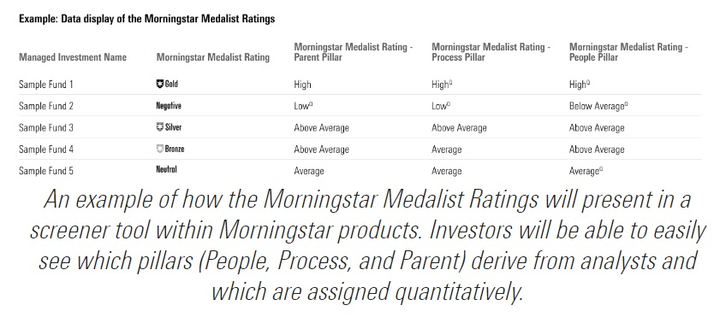

By uniting the Analyst Rating and Quantitative Rating under the Medalist Rating banner, Morningstar will move to a common ratings scale of Gold, Silver, Bronze, Neutral and Negative, removing the superscript "Q" designation from the ratings of managed investments assessed quantitatively.

The Analyst Rating and Quantitative Rating methodologies will not change and the three pillars—People, Process, and Parent—will continue to form the basis for the ratings. However, to help investors distinguish between pillars assessed by analysts and those assessed quantitatively, Morningstar will continue to apply the superscript "Q" designation to pillar ratings assigned quantitatively.

Morningstar does not expect any impact to the ratings it assigns to managed investments as a result of this change.

"The united ratings system not only reflects our confidence in the efficacy and quality of the two rating systems, but also, better reflects how the Quantitative Rating and Analyst Rating have been joined at the hip. We designed the Quantitative Rating to mimic the way manager research analysts assign ratings. Put another way, we can't generate the Quantitative Rating without the analysts' ongoing input."

<em>Lee Davidson, head of manager and quantitative research <a href="https://headless.en.rankiapro.com/tag/morningstar-awards/" target="_blank" rel="noreferrer noopener">at Morningstar</a>.</em>

By the end of the second quarter of 2023, Morningstar Medalist Ratings will be available in all Morningstar products and platforms globally that currently carry the Morningstar Analyst Rating and the Morningstar Quantitative Rating. This includes Morningstar.com, Morningstar DirectSM, Morningstar® Advisor WorkstationSM, Morningstar OfficeSM, data feeds, as well as other products and platforms such as Analyst® Research CenterSM.

Related articles

Lombard Odier and Robeco join forces to launch an emerging equity fund

Lombard Odier and Robeco join forces to launch an emerging equity fundBy RankiaPro Europe

Mirabaud AM launches a global bond investment strategy to anticipate rate cuts

Mirabaud AM launches a global bond investment strategy to anticipate rate cutsBy RankiaPro Europe