Do small caps have less resources for ESG criteria?

5 AUG, 2021

By Guillaume Chieusse

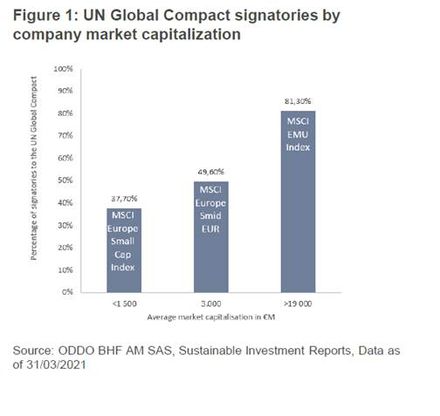

Our analysis shows, that the higher the market capitalization of a company, the greater the likelihood that it will be a signatory to the United Nations Global Compact (UNGC). UNGC is a voluntary initiative based on CEOs committing to implement universal sustainability principles and take action to support the UN's goals. While 81.3% of companies with an average market capitalization of more than €19 billion (MSCI EMU Index) are signatories to the UNGC, only 37.7% of companies, with an average market capitalization of less than €1.5 billion (MSCI Europe Small Cap Index), are signatories.

Companies that have joined the UNGC are required to submit an annual Communication on Progress (COP), which is an environmental, social and governance report. This accountability and reporting commitment can be a barrier to membership for small caps, even though the ten principles of the UNGC that focus on human rights, labor, environment and anticorruption are often incorporated into national practices and European laws in which small caps operate.

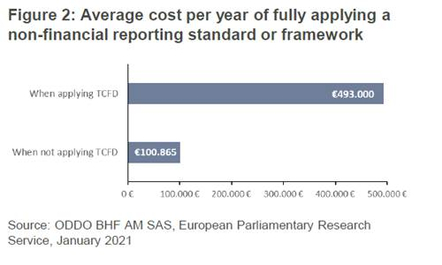

A public consultation from the European Parliamentary Research Service based on 80 responses shows that the average cost of fully applying a non-financial reporting standard or framework is EUR 100’865 per year, with the highest cost being at EUR 493’000 per year when applying the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information. This shows how challenging it can be for small caps to disclose efficiently on ESG topics as their annual revenue levels is traditionally around EUR1bn and they need to hold a balance between growth opportunities, R&D investments, profitability improvements and publications. The EU Non-financial Reporting Directive from 2014 (Directive 2014/95/EU) is being reviewed. There is strong support for the use of a simplified version of the standard for SMEs, but it remains to be seen whether this will solve the problems of comparability, reliability and relevance for the small cap segment, which is by definition difficult to standardize because it is so vast and diverse in terms of sectors, themes and countries.

Sustainability budgets offer much more room for manoeuvre for large companies. This is

traditionally due to their greater financial flexibility. In December 2020, Nestlé published a

detailed, time-bound plan to halve greenhouse gas (GHG) emissions by 2030 and achieve net

zero emissions by 2050. The plan calls for a total investment of 3.2 billion Swiss francs over the

next five years. As the company explains, these investments will be profit-neutral as they will

be financed mainly through operational and structural efficiencies. It is hard to imagine such a

non-dilutive investment in the small cap segment.