3 Emerging Market Funds on these selectors’ list

22 MAR, 2021

By Ana Andrés

It is commonly argued that there are plenty of opportunities in the Emerging Markets world, due to the multiple possibilities that these industries offer. These countries were hit by the COVID-19 pandemic in a significant manner, but right now, some of them are characterized by fast economic and social recovery. As explained by some of the best European Selectors, these are the most recommended 'Emerging Markets' funds to consider:

As explained by Kalinka Dyankova, fund analyst at Lyxor Fund Solutions: In 2020, Emerging markets were the first to be hit by the pandemic, however, they recovered quickly and delivered exceptional results. Over the year, Growth and Quality have outperformed value, while large caps outperformed small and mid-caps. During Q4, those factors reversed when the style rotation we experienced drove high beta stocks to outperform. Stylistically Value outperformed growth, while small caps were the best performer market cap-wise.

So far this year, Emerging markets lagged global equities and in February investors locked in profits after several months (including January 2021) of strong outperformance. Looking ahead, expectations are about recovery in growth than in advanced economies, helped by the pick-up in trade flows and emerging supply bottlenecks which should help improve EM exporters’ pricing power.

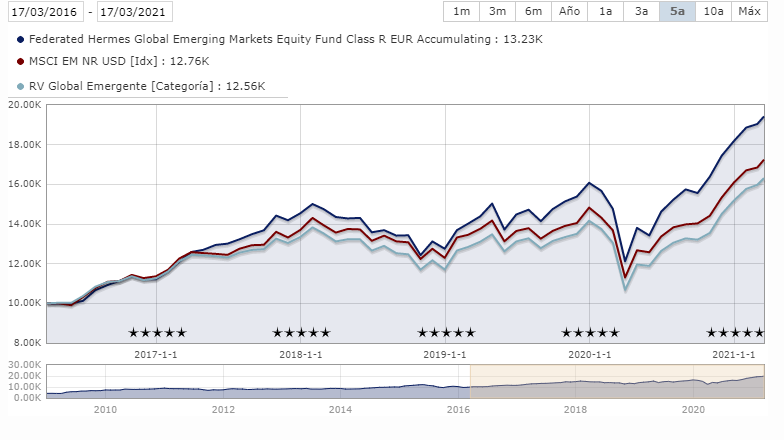

Federated Hermes Global Emerging Markets Equity fund

By A. Carballo from Wealth Solutions Partners SA

For more than 4 years this fund has been a core holding in our fund selection list to invest in Emerging Markets equities. The strategy focuses on bottom-up stock selection and has integrated ESG with explicit top-down analysis.

When we started to integrate ESG criteria in our fund selection process a few years ago, it was obviously that we wanted to seek out fund managers with a proven track record on stewardship and sustainable investing. Hence, Federated Hermes was an obvious choice given their long-lasting experience in responsible investing and engagement through their EOS specialists. The Asset Manager is not only deeply rooted in ESG but it also displays a solid EM equity platform benefiting from a large pool of internal resources.

In addition, we are convinced that the macro and top-down analysis matters in EM countries given the sensitivity to the currencies’ fluctuations, geopolitical risks or global trade among others. The team headed by Gary Greenberg who launched the strategy in 2011 has always explicitly integrated top-down and macroeconomic views in their investment process. The goal is to identify key risks but also structural changes that are shaping Emerging Markets in the long run. We think it is a real value-added over time.

Alpha generation for this fund is derived from a large array of sources and it has been very consistent. Stock selection is obviously the main contributor historically with more than 50% of relative performance. Beyond that, the investment team added value from country and sector allocation and across the whole market cap spectrum, which reflects the quality of the research and idea generation.

Even more important, the stock-picking is very good in areas that really matter for EM, namely Asia ex-Japan, and particularly in China, Taiwan and Korea. Bottom-up stock selection in Chinese names has been outstanding, posting positive contribution for each calendar years since 2013, the sole noteworthy exception being 2020. Sector-wise, alpha is mainly derived from Consumer-related industries, Financials and Technology, which represent on average 2/3 of the benchmark and is a structural overweight in the portfolio. Another key feature is that off-benchmark investments contribute positively to relative performance, which is what we expect from a benchmark agnostic strategy with high active share.

However, in this transitioning period, Federated Hermes is planning for a smooth long-term phase. They have focused on internal promotion, as they are used to do for other portfolio management’s responsibilities, with Kunjal Gala taking over the fund as lead decision maker. He is supported by a seasoned and experienced investment team, that promotes collegial communication and debates within a fairly flat structure.

The fund is soft-closing mid-June 2021, as the AUMs have reached nearly USD 8Bn. We welcome this initiative that highlights the discipline of Federated Hermes in its products’ capacity and its top-performing track record.

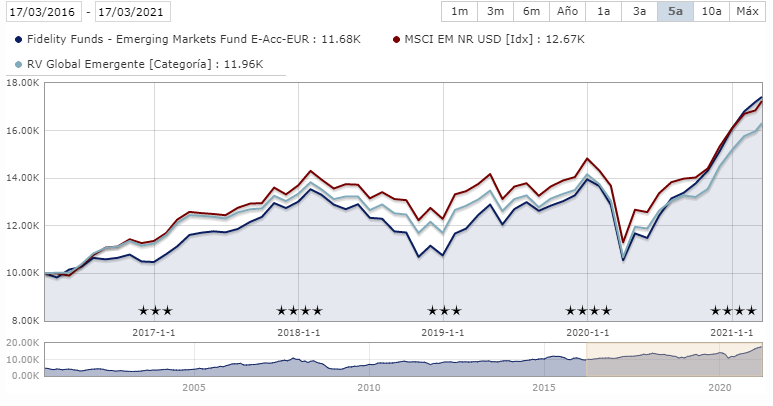

Fidelity Emerging Markets Fund

By Kalinka Dyankova, fund analyst at Lyxor Fund Solutions

According to Lyxor Asset Management, EM Inflation remains a key risk to monitor though:

In this context, Portfolio managers that have a true blend approach and the flexibility to orientate their portfolios throughout different market cycles were the better performers.

This fund is managed by Nick Price and Amit Goel. The investment team was able to deliver stellar performance in a difficult 2020. The true blended approach appeared in all its colors during the year. In 2019, the portfolio finished with a bias towards cyclical assets. Following the beginning of the pandemic, the team swiftly reviewed the portfolio and in January positioned it towards more defensive names and those that were proactive and took the initiative to develop their online platforms.

Exposure to Covid beneficiaries was one of the drivers of outperformance, however a significant additional contributor was due to the bias in semiconductors. At the end of Q3, the team correctly timed the style rotation and added to the fund’s materials exposure, which created a more balanced portfolio for the end of 2020.

The addition to financials on the back of lower valuations proved beneficial. It is good to point out that the fund is looking to invest in companies with healthy balance sheets, that can deliver resilient earnings over time. Being valuation conscious the team will not hesitate to top up positions in names hit by style rotation, where the fundamentals are still intact.

In 2021, the fund has retained its stellar performance and has delivered results above its benchmark (as of 12th March 2021), with the portfolio positioned to benefit from the reopening and the recovery of the economy. ESG and funds with sustainable focus were among the biggest drivers of AUM inflows for the past couple of years and even more in 2020. The performance of those strategies was ultimately tested last year and has proven its ability to generate alpha. It is possible to find the following fund as an example of this strategy:

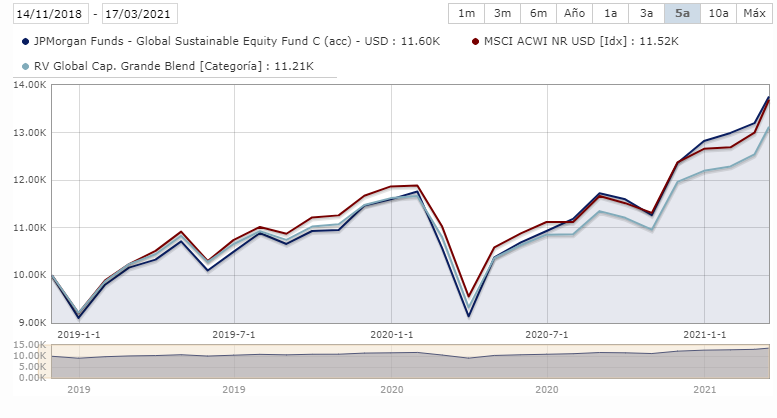

JPM EM Sustainable Equity Fund

By Kalinka Dyankova, fund analyst at Lyxor Fund Solutions

Although the funds' track record is quite short, it has been managed as a paper portfolio for the past 3 years. 2020 was a benign environment for the portfolio, which has a quality/growth profile investing in “best in class” sustainable companies. The investment team is happy to pay a premium for those businesses they believe can deliver in the long term. The fund is overweight Taiwan, as the country in their view, has a very good corporate governance culture, comparable to the rest of Asia, with payout ratios above its index.

On the other hand, South Korea, one of the best performers for 2020 is underweight as the sustainable factors do not meet the fundamentals. The investment team will not hesitate to divest or completely sell a company if it does not meet their criteria.